DB transfer scam warning flags reach record high Rates of scam warning flags rises for the fourth consecutive month

The number of pension transfers raising scam warning flags reached a record high in the month of April, according to the XPS Pensions Group.

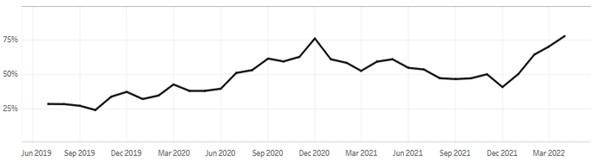

According to the XPS's scam flag index tracker, a total of 78% of the pension transfers reviewed raised at least one warning sign of a potential scam.

With this latest increase, the rates of scam warning flags have now risen for a fourth consecutive month.

XPS Scam Flag Index

The rise in scam warning flags coincides with a sharp increase in the number of scam guidance sessions from the Money and Pensions service.

While the number of scam warnings continues to rise, the transfer value index continued to fall, as the month end value of £232,000 represented a 5% decrease compared to the end of March.

Similarly, the XPS transfer activity index also saw a decrease, with number of members completing a transfer decreasing to an annualised rate of 35 members out of every 10,000, which stood at 38 in March.

Client lead of the member engagement hub Helen Cavanagh said: "Most transfer cases are now being assessed against the flags introduced in the 2021 transfer value regulations, with the overseas investments amber flag triggered in a majority of these cases.

"Complex or unclear fees, or the member not being aware of the fees they are being charged, are the other most common issues being observed."

Head of member options Mark Barlow added that with inflation hitting record levels, many savers may turn towards their pension to help them with the cost of living crisis. However, he urged members to proceed with caution.

"Transfer values have fallen by 15% since November to increasing interest rates, so we advise that members think carefully before accessing their pension in this way.

It is crucial that pension schemes take steps now to support their members in making such important decisions."

This article was originally published by Professional Pensions and is reproduced with permission