Calculating a deferred pension

All members of the New Section of the MNOPF are entitled to a deferred pension payable from the Normal Pension Age (NPA).

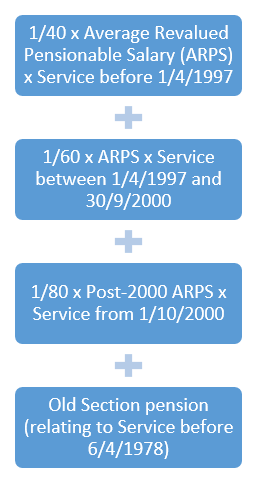

Your deferred pension is calculated as:

1/40 x Average Revalued Pensionabel Salary (ARPS) times Service before 1 April 1997,

plus 1/60 times ARPS times Service between 1 April 1997 and 30 September 2000,

plus 1/80 times Post-2000 ARPS times Service from 1 October 2000,

plus Old Section pension (relating to Service before 6 April 1978).

If you qualify for the Additional One Year’s Credit your deferred pension will be increased by an additional 1/40 x ARPS.

The MNOPF benefits described on this website are for your guidance only. The actual amounts of benefit you will receive are determined from the MNOPF Trust Deed and Rules. The amounts can vary according to your individual circumstances and, in some cases, are dependent on the dates you were a member of the Fund. Therefore, this site should be used as a source of general information only, with your individual entitlement being calculated and paid in accordance with the Trust Deed and Rules.

If you were an active contributing member of the MNOPF at 31 March 2016, contributed to the Ensign Retirement Plan (for the MNOPF) from 1 April 2016 to 31 March 2018, and you continue to contribute to the Ensign Retirement Plan from 1 April 2018, your deferred benefits within the MNOPF will be increased by an additional 1.5% per annum compound on top of the normal statutory revaluation that applies to deferred pensions. This will apply for each year that you remain an actively contributing member of the Ensign Retirement Plan up to your Normal Pension Age. Following a re-fresh of the brand, the Ensign Retirement Plan is now known as Ensign.